direct vs indirect cash flow gaap

Accordingly Free Cash Flow Non-GAAP for the three-month period ended March 31 2022 has been calculated on such basis and the calculations of Free Cash Flow Non-GAAP for each of the prior periods shown have been revised and conformed. Thats because the FCF formula doesnt account for.

Direct Vs Indirect The Best Cash Flow Method Vena

But it is not as easily manipulated by the timing.

. Under IFRS Standards bank overdrafts reduce the cash and cash equivalents balance in the statement of cash flows if they are repayable on demand and form an integral part of the companys cash. The direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method US GAAP allows businesses to choose the direct or indirect method but even when using the direct method a reconciliation of cash flow from operating activities to net profit net income is required. To align the cash outflow with the revenue CapEx is expensed on the income statement through depreciation a non-cash expense embedded within either COGS or OpEx.

Depreciation is calculated as the CapEx amount divided by the useful life assumption the number of years that the PPE will provide monetary benefits which effectively spreads the cost out more evenly. So GAAP requires that. Next calculate all the administrative costs and general costs that cant be directly allocated to the manufacturing of the product or service delivery.

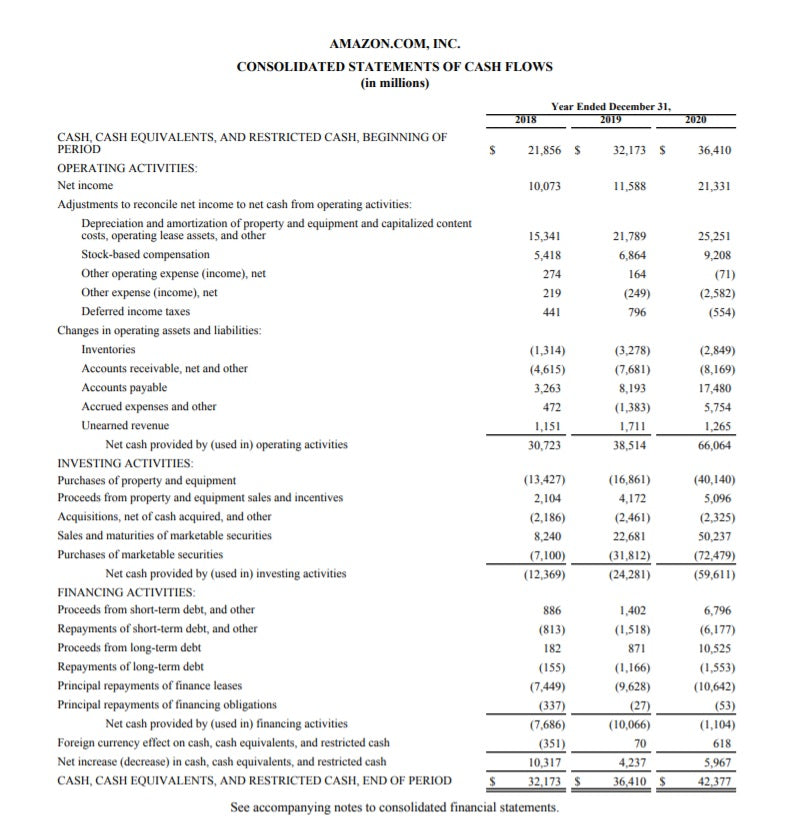

Net Cash Provided by Operating Activities GAAP 828. Operating cash flow formula. The cash flow statement measures the performance of a company over a period of time.

The US GAAP vs IFRS frameworks both have their own importance. The direct method and the indirect method. While to assess the accounting world on various capacities the two entities help a notable.

Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow. Why the US GAAP vs IFRS question matters over time in recent years US. And accounting policymakers and international regulators aim two merge the two systems together for a better outcome.

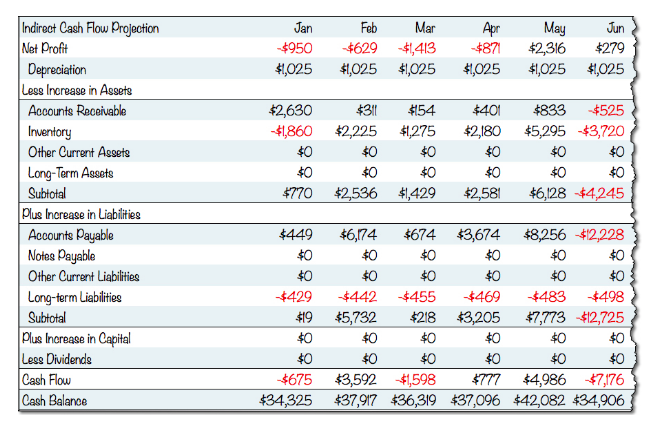

Direct vs indirect cash flow. See the Proposed amendments that would affect these classifications under IFRS Standards. In order to figure out your companys cash flow you can take one of two routes.

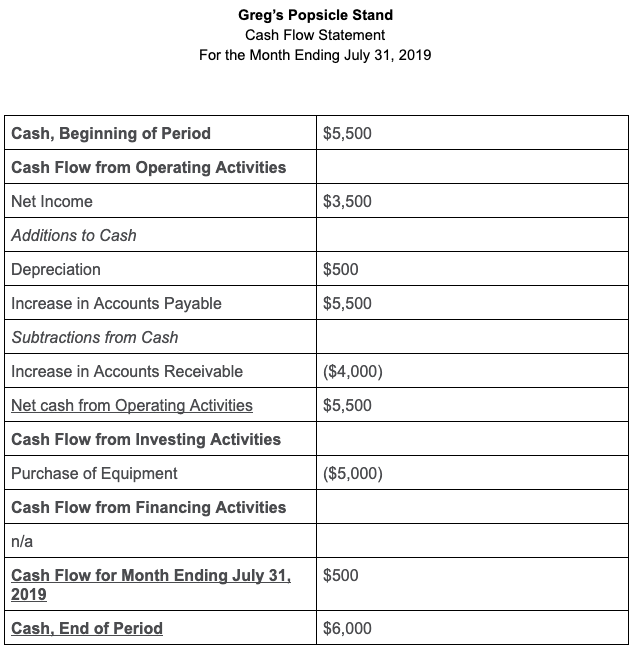

The direct method of calculating operating cash flow tracks all transactions as cash during a financial period and uses actual cash inflows and outflows on the cash flow statement. While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow. The direct method for calculating OCF is simple and accurate but does not give investors much information about the company its operations or its sources of cash.

Firstly it is to be determined which input costs are indirect by nature for the manufacturing of a product or service deliveryNext add up all these costs together to arrive at the total manufacturing overhead. The direct method of calculating cash flow. Cash Flow Statement vs.

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Cash may be net of bank overdrafts under IFRS Standards. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued.

While generally accepted accounting principles US GAAP approve both the indirect method is typically preferred by small businesses. Not under US GAAP. Statements of cash flow using the direct and indirect methods.

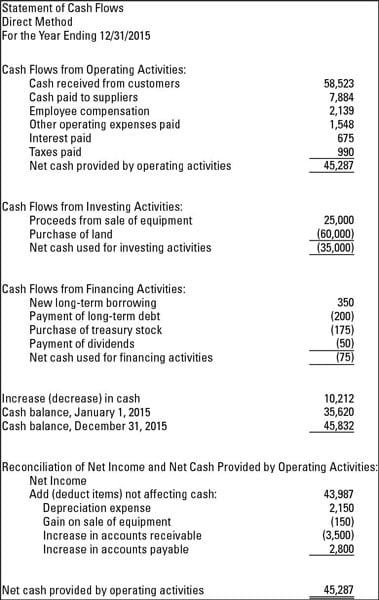

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Method Statement Of Cash Flows Youtube

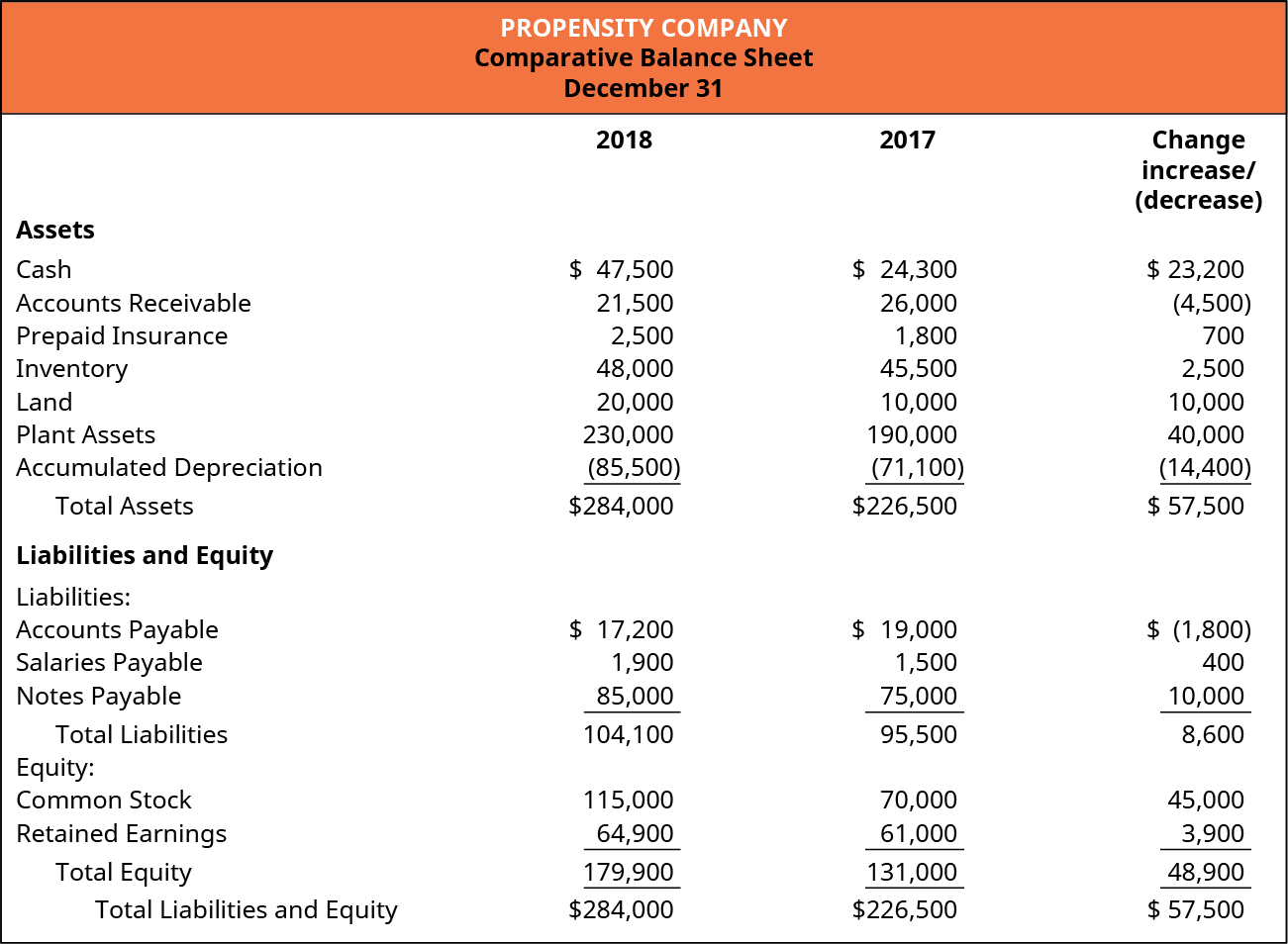

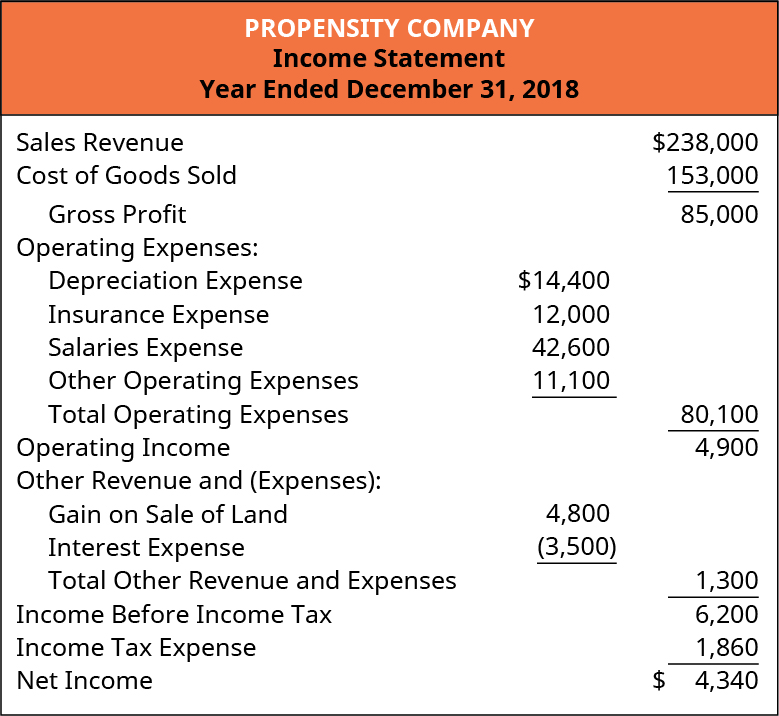

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

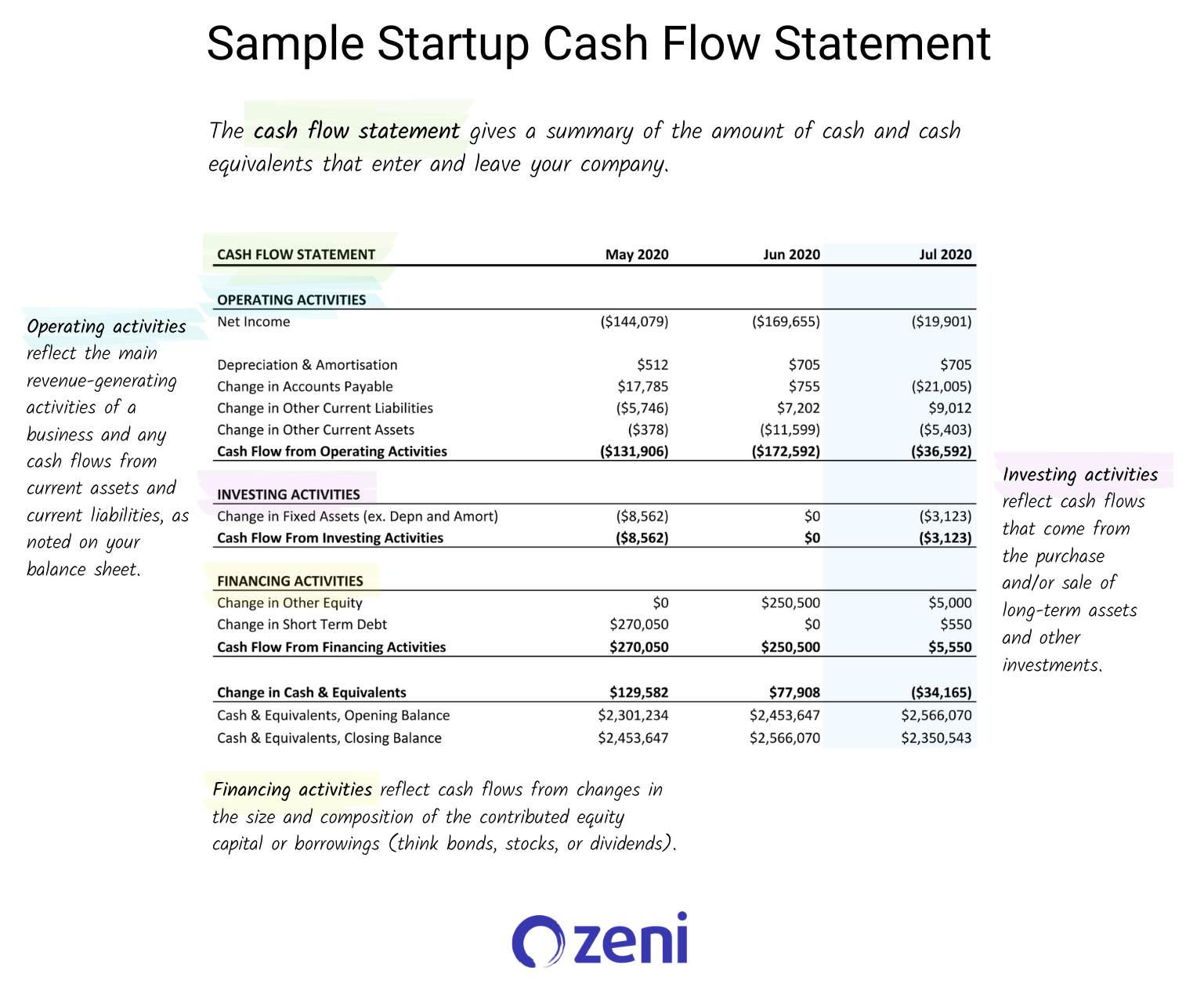

Everything You Need To Know About A Cash Flow Statement 2022

How To Read A Cash Flow Statement Zeni

Methods For Preparing The Statement Of Cash Flows Dummies

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

How Do Net Income And Operating Cash Flow Differ

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

How Do Net Income And Operating Cash Flow Differ

Disposal Of Assets Disposal Of Assets Accountingcoach

Cash Flow Statement Part 4 Bringing It All Together Ifrs Aspe Rev 2020 Youtube

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

How Are Cash Flow And Free Cash Flow Different

How To Prepare A Cash Flow Statement Online Accounting

Everything You Need To Know About A Cash Flow Statement 2022